Our Products

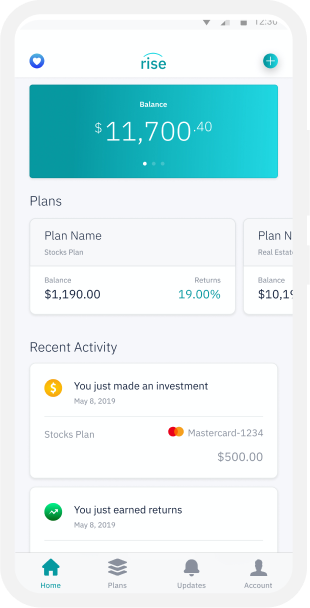

We are your global dollar hedge fund and

personal wealth manager in your pocket.

01

02

US Real Estate

03

Eurobonds

FAQs

Is Rise registered

Yes, Rise is registered with the Corporate Affairs Commission, RC Number:1622382 and holds users investments through its Cooperative License Number: 17080. Rise’s non-Nigerian investments are held through third-party partnerships with regulated entities in their respective jurisdictions.

How easily can I withdraw my investments

You can choose to withdraw your stock investment at any time and your Real Estate or Eurobond investments only at maturity. Withdrawals before maturity will attract a 5% penalty fee. When you process your withdrawal, your funds are deposited in your bank account within 3-5 working days.

What are my funding options?

You can choose to fund your Rise plan with your naira or USD debit or credit card. You can also fund by making a transfer from your bank account into your Rise wallet.

Can you teach me about investing?

Yes, we can. You can join our Telegram group or visit our blog - MoneyRise regularly. We share simple explainers, guides and insights to help you understand how to get the most out of your money.

Are my returns guaranteed?

Only Eurobonds returns are guaranteed. The others have various risk levels attached just like all investments, which means they may go up or down in the short term but will earn their returns in the long term.

What are your fees and charges?

- NGN Cards: From 1.4% to (1.5% + NGN 100) per transaction and capped at NGN 2000.

- USD Cards: From 2.9% to (3.9% + NGN100) per transaction.

There is NGN 35 transfer fee charged for withdrawals into bank accounts. And 5% withdrawal penalty fee charged on all withdrawals made from a locked (yet to mature) plan.

- No fees on investment with returns below 10%.

- 1.5% on investment with returns between 10% and 15%.

- 2% on investment with returns above 15%.